The Greatest Guide To Property By Helander Llc

The Greatest Guide To Property By Helander Llc

Blog Article

The Ultimate Guide To Property By Helander Llc

Table of ContentsWhat Does Property By Helander Llc Do?What Does Property By Helander Llc Do?What Does Property By Helander Llc Do?Getting The Property By Helander Llc To Work6 Simple Techniques For Property By Helander LlcOur Property By Helander Llc Statements

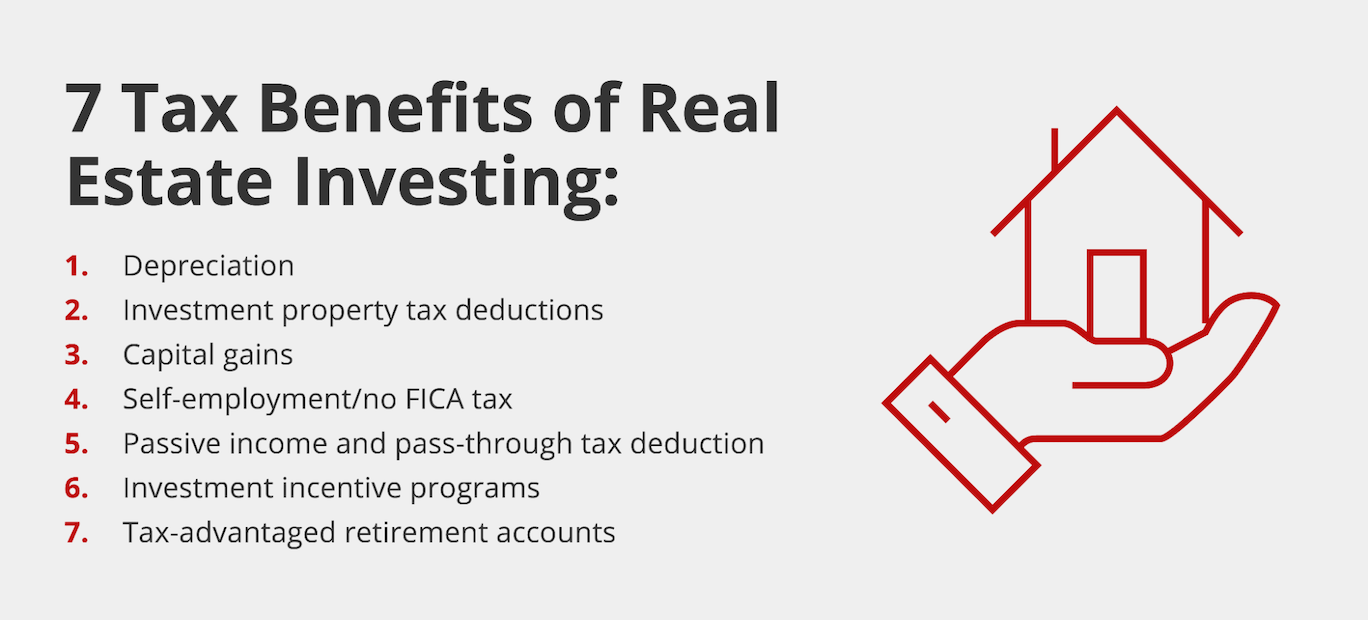

The advantages of investing in genuine estate are various. Right here's what you need to understand about real estate benefits and why actual estate is considered an excellent financial investment.The benefits of buying property include passive income, steady cash money flow, tax advantages, diversity, and utilize. Real estate investment trust funds (REITs) provide a way to buy genuine estate without needing to have, run, or finance properties - https://www.merchantcircle.com/blogs/-property-by-helander--sandpoint-id/2024/7/Finding-Your-Dream-Home-Exploring-Homes-for-Sale-in-Sandpoint-Idaho/2769012. Cash money circulation is the earnings from a property financial investment after home loan payments and business expenses have actually been made.

In most cases, cash flow only strengthens with time as you pay for your mortgageand develop up your equity. Genuine estate financiers can capitalize on various tax breaks and reductions that can save cash at tax time. In general, you can deduct the practical expenses of owning, operating, and handling a property.

A Biased View of Property By Helander Llc

Property values tend to boost in time, and with an excellent financial investment, you can make a profit when it's time to offer. Leas additionally tend to rise with time, which can lead to higher capital. This chart from the Reserve bank of St. Louis shows typical home costs in the united state

The areas shaded in grey indicate united state economic downturns. Average List Prices of Residences Cost the USA. As you pay for a property home mortgage, you develop equityan property that belongs to your internet worth. And as you construct equity, you have the leverage to purchase more buildings and raise cash flow and wide range much more.

Due to the fact that property is a concrete property and one that can function as security, financing is conveniently offered. Realty returns differ, relying on elements such as area, property class, and administration. Still, a number that many capitalists intend for is to defeat the typical returns of the S&P 500what many individuals describe when they state, "the marketplace." The rising cost of living hedging ability of property originates from the positive connection in between GDP growth and the demand for real estate.

Property By Helander Llc Can Be Fun For Anyone

This, consequently, converts right into greater capital worths. Actual estate often tends to keep the purchasing power of funding by passing some of the inflationary pressure on to occupants and by incorporating some of the inflationary stress in the kind of capital gratitude. Mortgage loaning discrimination is prohibited. If you think you've been discriminated versus based upon race, religious beliefs, sex, marital status, use public support, national origin, handicap, or age, there are actions you can take.

Indirect genuine estate spending involves no direct ownership of a home or homes. There are numerous ways that owning real estate can protect versus inflation.

Finally, residential properties financed with a fixed-rate funding will see the relative amount of the month-to-month home mortgage repayments fall over time-- for example $1,000 a month as a fixed settlement will come to be less burdensome as rising cost of living deteriorates the purchasing power of that $1,000. Often, a primary house is not considered to be an actual estate investment since it is made use of as one's home

Property By Helander Llc Can Be Fun For Anyone

Even with the assistance of a broker, it can take a couple of weeks of work simply to locate the appropriate counterparty. Still, property is an unique property course that's easy to recognize and can improve the risk-and-return profile of a capitalist's portfolio. On its very own, realty supplies cash circulation, tax breaks, equity structure, affordable risk-adjusted returns, and a bush versus rising cost of living.

Buying genuine estate can be an unbelievably fulfilling and profitable venture, however if you resemble a great deal of brand-new financiers, you may be asking yourself WHY you should be buying realty and what benefits it brings over other investment chances. In enhancement to all the incredible advantages that come along with spending in realty, there are some downsides you need to take into consideration as well.

The Only Guide for Property By Helander Llc

At BuyProperly, we make use of a fractional possession design that enables capitalists to start with as little as $2500. One more major benefit of real estate investing is the ability to make a high return from buying, renovating, and marketing (a.k.a.

Most flippers a lot of for undervalued buildings underestimated great neighborhoodsExcellent The fantastic point regarding investing in real estate is that the value of the residential or commercial property is expected to appreciate.

Little Known Questions About Property By Helander Llc.

For instance, if you are charging $2,000 lease per month and you incurred $1,500 in tax-deductible costs monthly, you will just be paying tax obligation on that $500 revenue per month. That's a huge difference from paying tax obligations on $2,000 each month. The profit that you make on your rental unit for the year is taken into consideration rental revenue and will certainly be taxed appropriately

Report this page